Category: Home Selling

4 Tips to Make Your Home Sell Faster

Since June of last year, we have seen an increase in the inventory of homes for sale month per month. Every spring and summer, the inventory increases because people want to sell their home. For those with children, they may want to be in their new home for the beginning of the school year.

If you are one of those sellers, you may find these 4 tips helpful in getting your home sold more quickly.

1. Make buyers feel at home

Declutter your home! Pack away all personal items like pictures, awards, and sentimental belongings. Make them feel like they belong in this house! According to the Profile of Home Staging by the National Association of Realtors,

“83% of buyers’ agents said staging a home made it easier for a buyer to visualize the property as a future home.”

Not only will your house spend less time on the market, but the same report mentioned that,

“One-quarter of buyers’ agents said that staging a home increased the dollar value offered between 1 – 5%, compared to other similar homes on the market that were not staged.”

2. Keep it organized

Since you took the time to declutter, keep it organized! Before the buyers show up, pick up toys, make the bed, and put away clean dishes. It is also a good idea to put out some cookies fresh from the oven or a scented candle. Buyers will remember the smell of your home! According to the same report, the kitchen is one of the most important rooms to stage in order to attract more buyers.

3. Give buyers full access

One of the top four elements when selling your home is access! If your home is available anytime, that opens up more opportunity to find a buyer right away. Some buyers, especially those relocating, don’t have much time available. If they cannot get into the house, they will move on to the next one.

4. Price it right

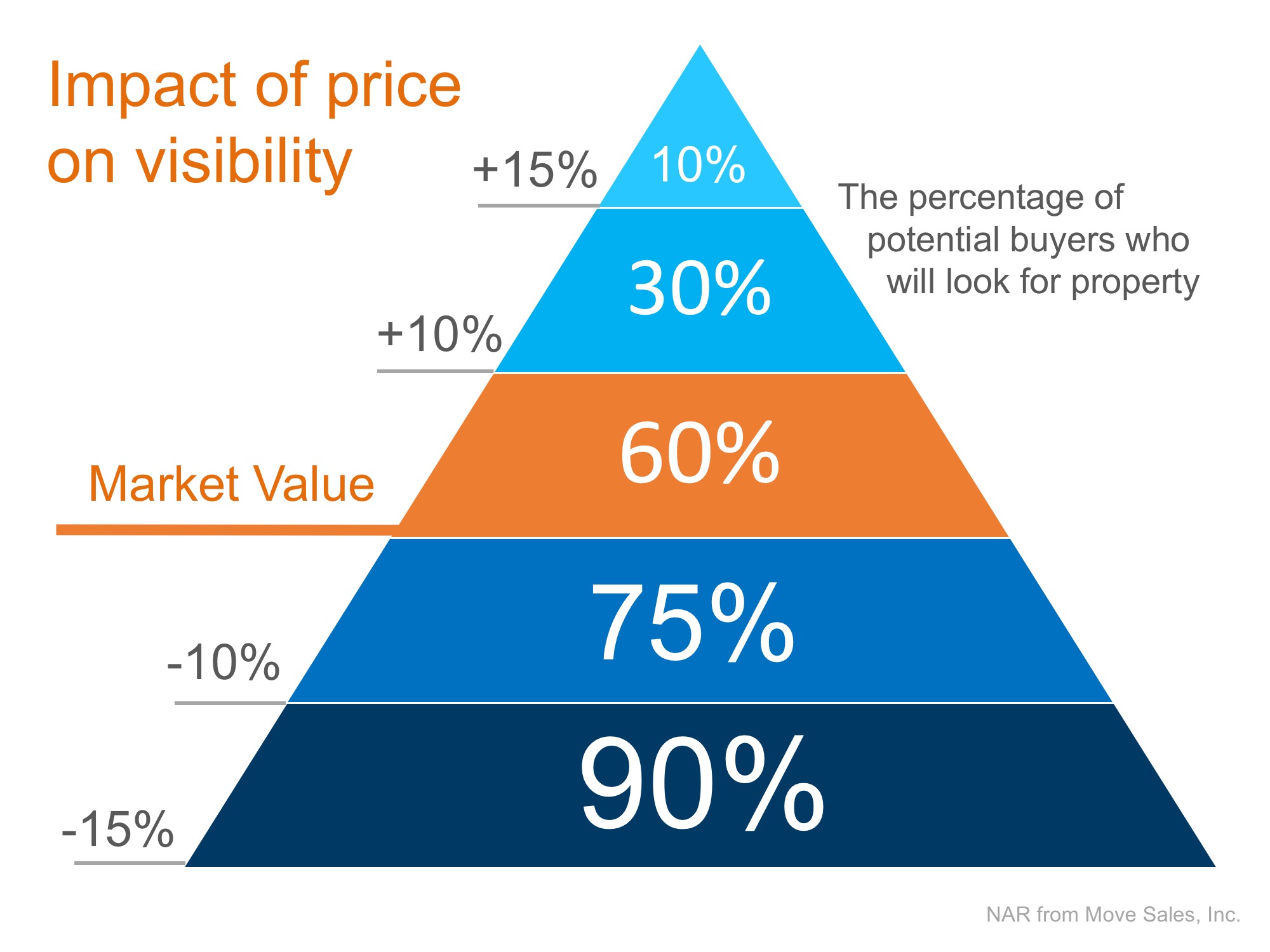

As we mentioned at the beginning, more inventory coming into the market guarantees there will be some competition. You want to make sure your home is noticed. The key to selling your house in 2019 is ensuring it is Priced to Sell Immediately (PTSI). That way, your home will be seen by the greatest amount of buyers and will sell at a great price before more competition comes to market!

Bottom Line

If you want to sell your house in the least amount of time at the best price with as little hassle as possible, a local real estate professional is a useful guide. Call them today to find out what you need to do to sell your home more quickly.

New Study Reveals One Surprising Reason for the Inventory Shortage

There has been a great amount written on millennials and their impact on the housing market. However, the headlines often contradict each other. Some claim this generation is becoming the largest share of first-time home buyers, while others claim millennials don’t want to own a home, blaming them for the dip in homeownership rate.

While it is true that millennials have achieved milestones like getting married, having kids, and buying homes later in life than their parents and grandparents did, they are not solely to blame for today’s housing market trends.

Freddie Mac’s Insight Report explored the impact of the Silent and Baby Boomer Generations on the housing market.

If millennials are unable to find a home to buy at a young age like their predecessors, then who is living in those homes?

The answer: Seniors born after 1931 are staying in their homes longer than previous generations, instead choosing to “age in place.”

Freddie Mac found that,

“this trend accounts for about 1.6 million houses held back from the market through 2018, representing about one year’s typical supply of new construction, or more than half of the current shortfall of 2.5 million housing units estimated in December’s Insight.

Older Americans prefer to age in place because they are satisfied with their communities, their homes, and their quality of life.”

According to the National Association of Realtors, inventory of homes for sale is currently at a 3.5-month supply, which means that nationally we are in a seller’s market. A ‘normal’ housing market requires 6-7 months inventory, a level we have not achieved since August 2012.

“The most important fundamental in today’s housing market is the lack of houses for sale. This shortage has been identified as an important barrier to young adults buying their first homes.”

Bottom Line

If you are one of the many seniors who desires to retire in the same area you’ve always lived, you’re not alone. Will your current house fit your needs throughout retirement? If you have any questions about demand for your house, let’s get together to discuss the opportunities available today! Call me at 407-925-7721

5 Reasons To Sell Your House This Spring!

Here are five compelling reasons listing your home for sale this spring makes sense.

1. Demand Is Strong

The latest Buyer Traffic Index from the National Association of Realtors (NAR) shows that buyer demand remains strong throughout the vast majority of the country. These buyers are ready, willing, and able to purchase… and are in the market right now! More often than not, multiple buyers are competing with each other for the same home.

Take advantage of the buyer activity currently in the market.

2. There Is Less Competition Now

Housing inventory is still under the 6-month supply needed for a normal housing market. This means that, in most of the country, there are not enough homes for sale to satisfy the number of buyers.

Historically, the average number of years a homeowner stayed in his or her home was six, but that number has hovered between nine and ten years since 2011. Many homeowners have a pent-up desire to move, as they were unable to sell over the last few years due to a negative equity situation. As home values continue to appreciate, more and more homeowners are granted the freedom to move.

Many homeowners were reluctant to list their home over the last couple of years for fear that they would not find a home to move in to. That is all changing now as more homes come to market at the higher end. The choices buyers have will continue to increase. Don’t wait until additional inventory comes to market before you to decide to sell.

3. The Process Will Be Quicker

Today’s competitive environment has forced buyers to do all they can to stand out from the crowd, including getting pre-approved for their mortgage financing. Buyers know exactly what they can afford before home shopping. This makes the entire selling process much faster and simpler. According to Ellie Mae’s latest Origination Insights Report, the time to close a loan has dropped to 47 days.

4. There Will Never Be a Better Time to Move Up

If your next move will be into a premium or luxury home, now is the time to move up! The inventory of homes for sale at these higher price ranges has created a buyer’s market. This means that if you are planning on selling a starter or trade-up home, it will sell quickly, AND you’ll be able to find a premium home to call your own!

According to CoreLogic, prices are projected to appreciate by 4.6% over the next year. If you are moving to a higher-priced home, it will wind up costing you more in raw dollars (both in down payment and mortgage payment) if you wait.

5. It’s Time to Move on With Your Life

Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should?

Only you know the answers to these questions. You have the power to take control of the situation by putting your home on the market. Perhaps the time has come for you and your family to move on and start living the life you desire.

That is what is truly important.

Want to Get the Most Money from The Sale of Your Home? Use These 2 Tips!

Every homeowner wants to make sure they maximize their financial reward when selling their home. But how do you guarantee that you receive the maximum value for your house?

Here are two keys to ensure that you get the highest price possible.

1. Price it a LITTLE LOW

This may seem counterintuitive, but let’s look at this concept for a moment. Many homeowners think that pricing their homes a little OVER market value will leave them with room for negotiation. In actuality, this just dramatically lessens the demand for your house (see chart below).

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price it so that demand for the home is maximized. By doing this, the seller will not be fighting with a buyer over the price but will instead have multiple buyers fighting with each other over the house.

HGTV gives this advice:

“First impressions are everything when selling your home. Studies have shown that the first two weeks on the market are the most crucial to your success. During these initial days, your home will be exposed to all active buyers.

If your price is perceived as too high, you will quickly lose this initial audience and find yourself relying only on the trickle of new buyers entering the market each day. Markets are dynamic, and your price has an expiration date. You have one chance to grab attention. Make sure your pricing helps you stand out on the shelf — in a positive way.”

2. Use a Real Estate Professional

This, too, may seem counterintuitive. The seller may believe that he or she will make more money without having to pay a real estate commission, but studies have shown that homes typically sell for more money when handled by a real estate professional.

Research by the National Association of Realtors in their 2018 Profile of Home Buyers and Sellersrevealed that,

“the median selling price for all FSBO homes was $200,000 last year. However, homes that were sold with the assistance of an agent had a median selling price of $264,900 –nearly $65,000 more for the typical home sale.”

Bottom Line

Price your house at or slightly below the current market value and hire a professional. This will guarantee that you maximize the money you get for your house.

Why Houses DO NOT Sell in a Strong Market

As we approach the end of the year, many homeowners find themselves asking the question, “If we’re currently in a strong real estate market, why won’t my house sell?”

Below are the 5 most common reasons why a listing contract will expire:

1. The Price

Sometimes when the market is hot, homeowners attempt to set their listing price higher. Their hope is that a motivated buyer will be willing to pay any price for a house in their desired neighborhood! Sellers must remember, though, that in today’s market a house must be sold twice; first to the buyer and then to their bank.

A buyer can agree to pay the homeowner’s asking price, but after the bank conducts their appraisal, the price might need to be adjusted. The bank will only give the buyer a mortgage for the value of determined in the appraisal.

Sellers must also keep in mind that today’s homebuyers are well-educated. Before they look to buy a house, they have already seen many houses online. They’ve done their research on the neighborhoods they are interested in, including information on the school districts in the area.

They will know if your house seems overpriced and will not waste their time considering it. This is why it’s so important to make sure that your home is priced right from day one on the market!

2. The Condition of the House

In many areas, builders are taking advantage of the lack of inventory of homes for sale by building new houses. These newly constructed homes create competition for existing homes in the market. For this reason, many homeowners are making renovations and updates to their homes to compete with the new construction in their marketplace.

Most agents recommend that homeowners declutter their houses before putting them on the market. Buyers want to be able to imagine themselves living in the home instead of focusing on the current homeowner’s decor.

It’s important to take care of the small problems like dripping faucets and torn screens, while also remembering to remove any posters hanging in your teenager’s bedroom. Making sure your home is in perfect condition will make buyers fall in love with it and will ultimately help you get the right price for your house!

3. Seller’s Motivation

Why did the seller put their house on the market in the first place? Is the seller’s motivation still the same as it was when they first listed?

If homeowners are really motivated to sell, they will make sure their houses are both priced right and in good condition. The seller’s motivation will push them to consider all offers and help them make the right decision for their family’s future.

4. Marketing Plan

Having a marketing plan is important! According to NAR’s 2018 Profile of Home Buyers and Sellers, 95% of buyers searched online for a home last year. The days of looking for a newspaper ad or yard sign in your preferred neighborhood are over.

If you want to sell your home, you need a real estate professional who understands your local market and knows how to promote your home online. Something as simple as using pictures taken by a professional photographer can make a huge impact in advertising your home!

5. Lack of Communication with Your Agent

Keeping an open line of communication with your agent is crucial in getting your home sold with the least amount of hassles, in the right amount of time, and for the right price! From the beginning, establish a continuous line of communication with your agent, and make sure you review your agreement often to see if any changes need to be made. For example, adjusting the selling price!

Bottom Line

There are houses selling every single day because they are listed at the right price, they have the right marketing plan, and they are staged for the sale. If for some reason your home didn’t sell and you’re still motivated to get it sold, let’s get together to figure out the reason your house isn’t selling!

The #1 Reason to Not Wait Until Spring to Sell Your House

Many sellers believe that spring is the best time to place their homes on the market because buyer demand traditionally increases at that time of year, but what they don’t realize is that if every homeowner believes the same thing, then that is when they will have the most competition!

The #1 Reason to List Your Home in the Winter Months is Less Competition!

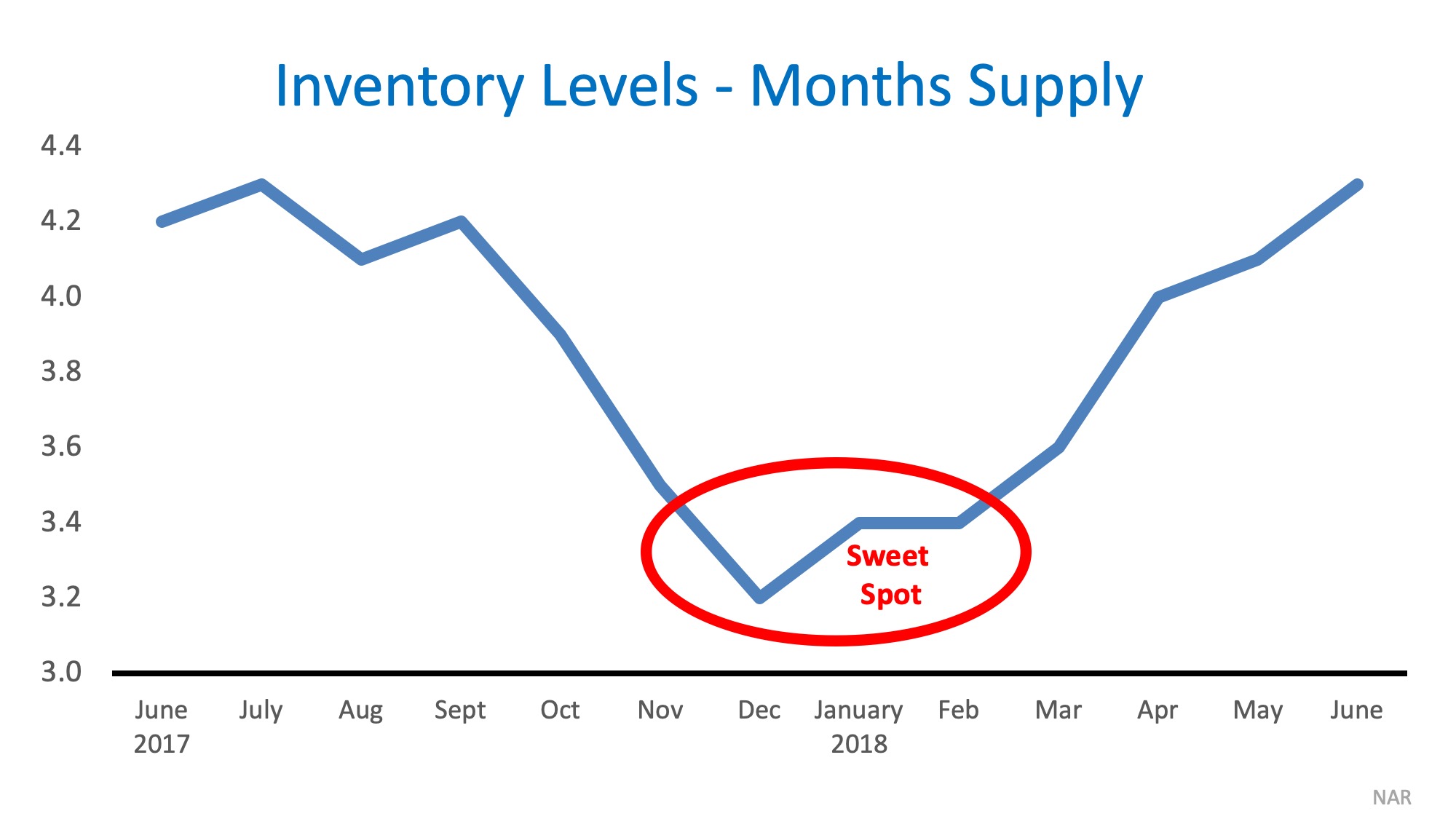

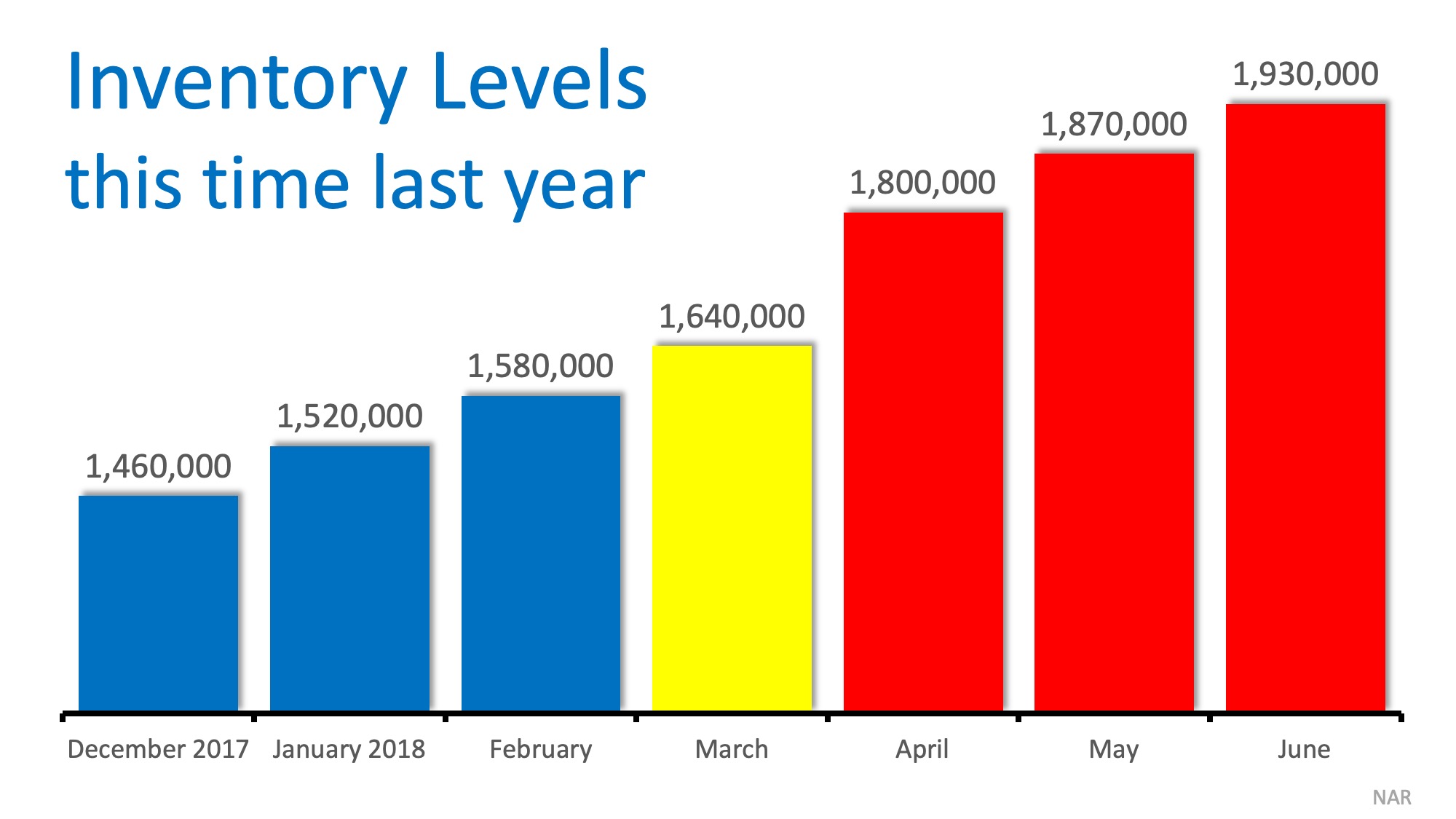

Housing supply traditionally shrinks at this time of year, so the choices buyers have will be limited. The chart below was created using the months’ supply of listings from the National Association of Realtors.

As you can see, the ‘sweet spot’ to list your home for the most exposure naturally occurs in the late fall and winter months (November – February).

Temperatures aren’t the only thing that heats up in the spring – so do listings!

In 2017, listings increased by nearly half a million houses from December to June. Don’t wait for these listings to come to market before you decide to list your house.

Added Bonus: Only Serious Buyers Are Out in the Winter

At this time of year, only those purchasers who are serious about buying a home will be in the marketplace. You and your family will not be bothered and inconvenienced by mere ‘lookers.’ The lookers are at the mall or online doing their holiday shopping.

Bottom Line

If you have been debating whether or not to sell your home and are curious about market conditions in your area, let’s get together to help you decide the best time to list your house for sale.

Thinking of Selling Your Home? Here’s Why You Need A Pro in Your Corner

With home prices on the rise and buyer demand still strong, some sellers may be tempted to tryand sell their homes on their own without using the services of a real estate professional.

Real estate agents are trained and experienced in negotiation and, in most cases, the seller is not. Sellers must realize that their ability to negotiate will determine whether or not they get the best deal for themselves and their families.

Here is a list of just some of the people with whom the seller must be prepared to negotiate with if they decide to For Sale by Owner (FSBO):

- The buyer who wants the best deal possible

- The buyer’s agent who solely represents the best interests of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies, which work for the buyer and will almost always find someproblems with the house

- The termite company if there are challenges

- The buyer’s lender if the structure of the mortgage requires the sellers’ participation

- The appraiser if there is a question of value

- The title company if there are challenges with certificates of occupancy (CO) or other permits

- The town or municipality if you need to get the CO permits mentioned above

- The buyer’s buyer in case there are challenges with the house your buyer is selling

Bottom Line

The percentage of sellers who have hired real estate agents to sell their homes has increased steadily over the last 20 years. Let’s get together to discuss all that we can do to make the process easier for you.

If You Are Thinking of Selling? You Must Act NOW!

If you thought about selling your house this year, now more than ever may be the time to do it! The inventory of homes for sale is well below historic norms and buyer demand is skyrocketing. We were still in high school when we learned about the concept of supply and demand, so we understand that the best time to sell something is when the supply of that item is low and demand for that item is high. That defines today’s real estate market.

Lawrence Yun, Chief Economist at the National Association of Realtors, recently commented:

“Contract signings inched backward once again last month, as declines in the South and West weighed down on overall activity.”

Yun goes on to say:

“The reason sales are falling off last year’s pace is that multiple years of inadequate supply in markets with strong job growth have finally driven up home prices to a point where an increasing number of prospective buyers are unable to afford it.”

In this type of market, a seller may hold a major negotiating advantage when it comes to price and other aspects of the real estate transaction, including the inspection, appraisal and financing contingencies.

Bottom Line

As a potential seller, you are in the driver’s seat right now. It might be time to hit the gas.

Dream Home

And I’ll help you find it. Call Linda at 407-925-7721 Cell or Text